#ES_F Futures Daily Analysis Mar 6th 2024

The market got too short yesterday. Can it find legs to continue the one timeframing down?

Previous Session Debrief

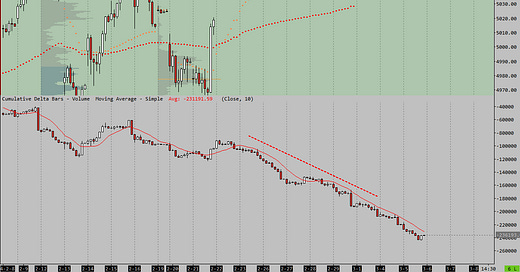

After a weak close Monday the market auctioned lower overnight leading to an 18 point gap at the Open. After an Open Auction in A period, B period took out the high of A period attempting to close the gap and then the low of A period extending the IB down to 27 points.

After the IB was set C period quickly took the IBL but found buyers around 5090 which was the pullback low from 2/29, the trend day up. We balanced in this area from C to I period with a false break in E period.

I period finally extended the lows and we OTFD in I through L period where we finally saw signs the market got too short. M period left a poor low as we rallied 25.25 points into the close as weak shorts covered their positions to go home flat.

Key Takeaways:

Strong rvol at 1.5 mln contracts and good range at 58.5 points.

Delta -20k.

Bearish unfilled gap and singles.

Poor low.

Premarket Brief

Updated at 0900 CT

The overnight session traded in a tight range of 8 points for most of the Asian session. In L period buyers lifted the market to build another distribution inside of the B period singles.

ES and NQ are both moving higher and trading above yesterday’s value while RTY is moving higher inside value.

European indices traded generally higher through the early part of the session; among better performing sectors are industrials and technology; sectors inclined to the downside include consumer discretionary and materials; Fresenius Medical Care divests its Latam dialysis unit to Davita; focus on UK Spring Budget, BOC rate decision and ADP employment figures to be released later in the day; earnings expected in the upcoming US session include Foot Locker, Abercrombie & Fitch, Telecom Italia and Pirelli.

- Newsquawk

Notable Earnings:

No notable earnings today.

Notable Releases (central time):

0715: ADP Employment Report

0900: Jerome Powell | JOLTS

0930: EIA Petroleum Status Report

1030: 4-mo Bill auction

1100: Mary Daly

1300: Beige Book

1515: Neel Kashkari

Current Business:

ADP Employment Report before the open

Mission Plan

Yesterday we had good range so the probability of an inside day is higher today. We have several large releases and Fed speakers this week including Jerome Powell. I will be paying particularly close attention to the open and what kind of confidence we have at the open. The first indication is how the Opening price is respected.

We might likely have choppy price action today as we await Jerome Powell’s testimony in front of congress. I think it is important to keep a fresh perspective to market-generated information after big releases or speakers. I will like not trade today.

Scenario 1

I will be watching for a continuation of the auction higher from the overnight session.

5100 is my Over/Under for this idea. If we pull back to this area I want to see buyers step in here.

5121 PHOD is where I am looking for initial resistance. If we can build above I look for the gap to fill. If we find sellers here I look for a reversion to the Over/Under at 5100.

5128 is Half-gap

5135 is the Gap fill and 2σ↑, my target for this move.

Scenario 2

If we see a second day of weakness I will be cautious getting involved in the middle of the range.

5085 pSettle is my Over/Under for this idea. This level is 30 points below us at this point but if the market gets spooked it can get there pretty fast.

5063 is pLOD. I look for weakness to auction to pLOD and clean up the poor low. I need to see good selling tempo for a move below pLOD. I will look for the market to revert back to value and close in the bottom of the range.

5052 Gap Top is my extreme target for this idea.